Give Through Your Donor Advised Fund (DAF)

A donor-advised fund (DAF) is a simple and flexible way to support the causes you care about. DAFs allow donors to recommend grants to nonprofits over time, helping turn charitable resources into meaningful impact. With more than $230 billion currently held in DAF accounts, these funds represent a powerful opportunity to create positive change.

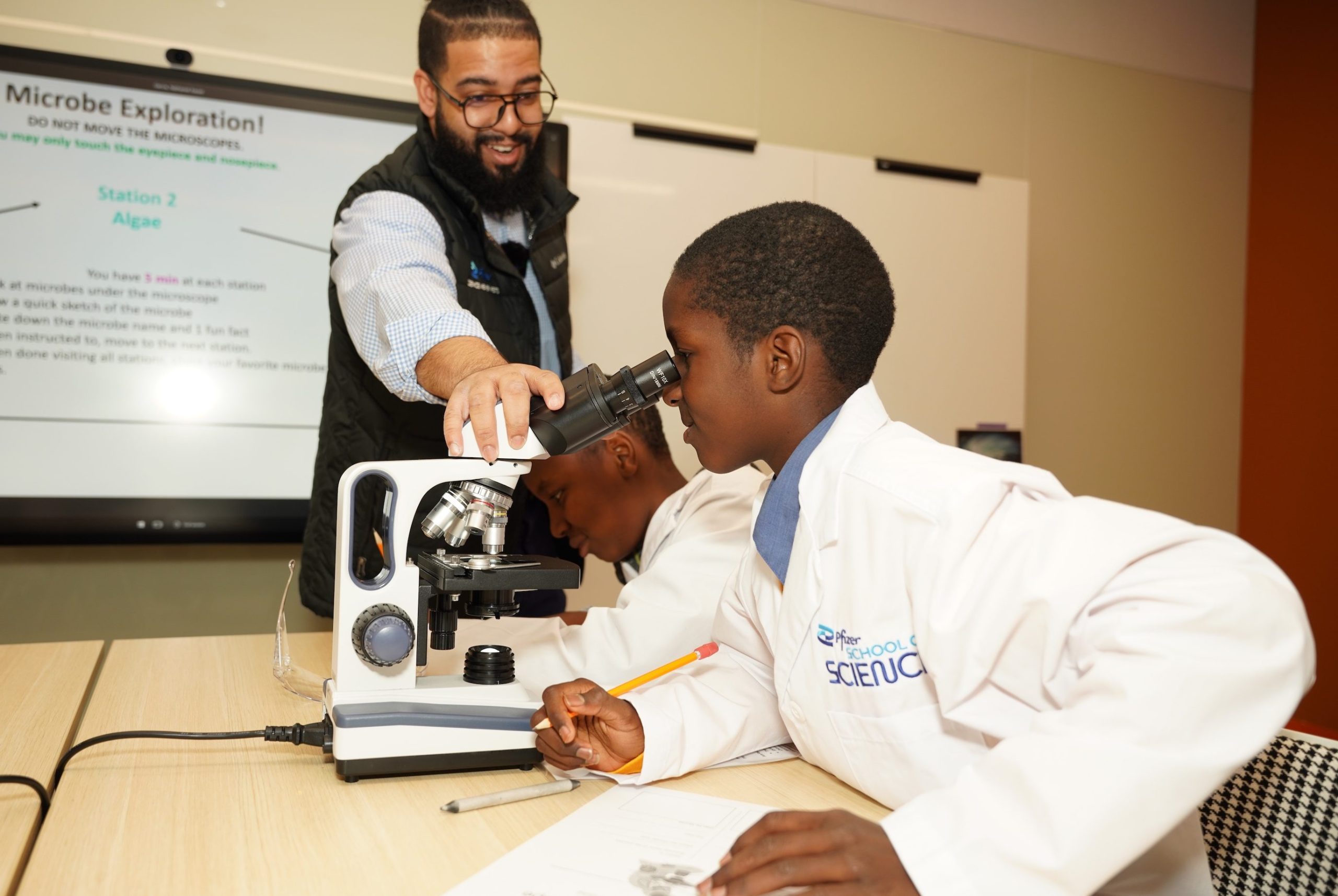

By recommending a grant from your DAF, you can help expand opportunities and empower youth across New York City.

What is a DAF?

A Donor Advised Fund (DAF) is your personal charitable savings account or charitable investment account. You contribute money or assets now, then recommend grants to causes you care about whenever you’re ready.

DAFs are the fastest-growing charitable giving vehicle in the U.S. because they offer one of the easiest and most tax-advantageous ways to support the causes you care about.

Key Benefits

Immediate Tax Deduction Get tax benefits when you contribute, plus tax-free growth of funds over time

Eliminate Capital Gains Avoid capital gains tax on appreciated assets held for more than a year

Simplified Giving Keep all charitable donations organized in one easy-to-manage account

Legacy Planning Create lasting impact and involve family members in charitable decisions

How DAF Giving Works

-

- Contribute – Make a contribution to your DAF with cash, securities, or other assets

-

- Get Tax Benefits – Receive immediate tax deduction and let your funds grow tax-free

-

- Recommend Grants – Direct funds to your favorite charities on your timeline

- Make Impact – Support causes you care about while building a lasting legacy

-

Ready to Give Through Your DAF?

Use our secure online tool below, DAF Direct, to connect your DAF and recommend a grant in just three clicks.

Why Use DAF Direct?

- Fast, secure donations with end-to-end encryption

- Works with 1000+ DAF providers

- Real-time grant requests

- No lost checks or mailing delays

Important to Know

Processing Time: Grants from DAFs can take several days or weeks to arrive at the charity.

Privacy Note: Your DAF sponsor may not share your contact information with us. Please reach out to us directly so we can properly thank you for your gift.

Tip: Until DAF assets are granted, they’re not helping the causes you care about. Consider making grants regularly to maximize your impact.

Stay Connected

When you give through your DAF, please let us know so we can:

- Properly thank you for your generosity

- Provide updates on how your gift is making a difference

- Share information about future giving opportunities

- Help with any questions about DAF giving

Contact Nancy Guida, Chief Advancement Officer, at nguida@newyorkedge.org

For Tax and Legal Purposes

When setting up your DAF grant or including us in your legacy planning, please use our complete legal information:

Legal Name: New York Edge, Inc

Address: 58-12 Queens Blvd Ste 1, Woodside, NY 11377

Federal Tax ID (EIN): 11-3112635